You found the laser machine to grow your business but how does financing capital equipment work?

By Sarah Wehrle, Finance Placement Specialist at Mazak Credit Corp.

You have it all figured out. You have filtered through different laser manufacturers, you attended the machine demonstrations, figured out exactly which laser-cutting machine and automation solution best fits your fabrication needs, the feasibility cuts and time study results have been reviewed, ROI analysis are complete, and you’re ready to sign that order form. But wait, how are you going to pay for this brand-new fiber laser?

Purchasing capital equipment is one of the most common reasons that small businesses look for outside financing. Having the ability to upgrade or add new machinery to your operations allows companies to grow without having to pay for it all up front. According to the results of the 2016 Foundation Borrower Survey, 78% of respondents indicated that they used at least one form of financing when acquiring equipment in fiscal year 2015.

What are my equipment financing options?

There are three common options that fabricators and manufacturers have available to secure financing for their capital equipment.

- Loans, equipment finance agreements or simple interest loan.

- Capital leases - finance lease, lease purchase, or $1 buy-out lease.

- Operating leases - Tax lease, true lease or fair market value (FMV) leases.

It is important to understand each of them so you can determine which financing option best fits your financial and business needs.

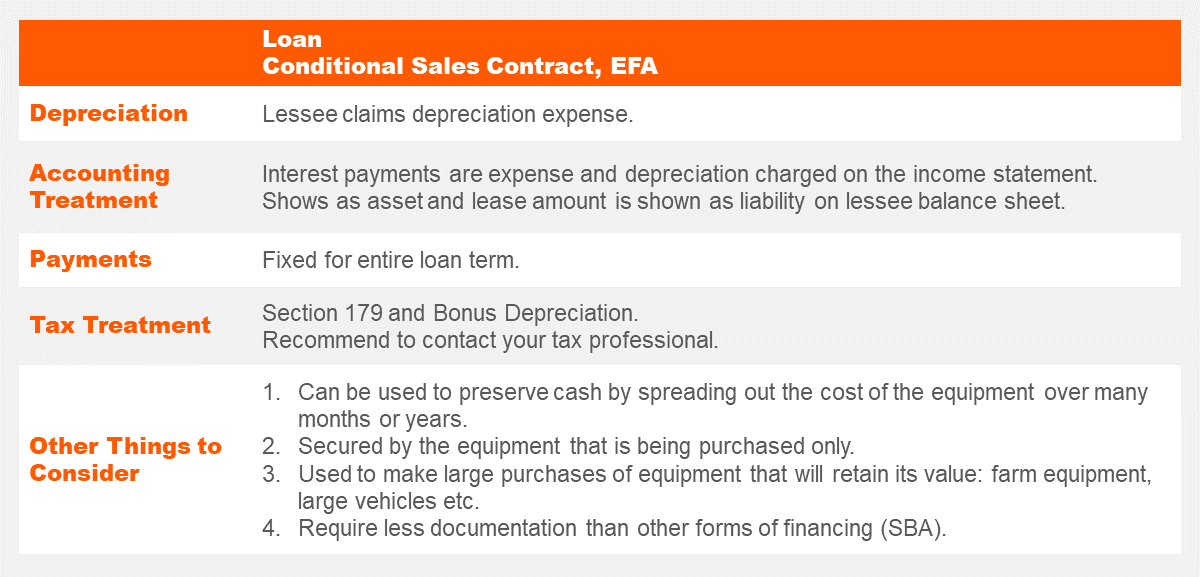

Loans, equipment finance agreements, and simple interest loans

These types of financial agreements are the simplest form of financing. It is a capital purchase where the lessee owns the equipment and takes the depreciation expense. The customer makes equal monthly payments for a set period. At the end of the payment term, the equipment is fully amortized, and the company owns the equipment free and clear. Simple interest loans are available at a slightly higher interest rate and allow for more flexibility on early payoffs and additional principal payments without any penalty.

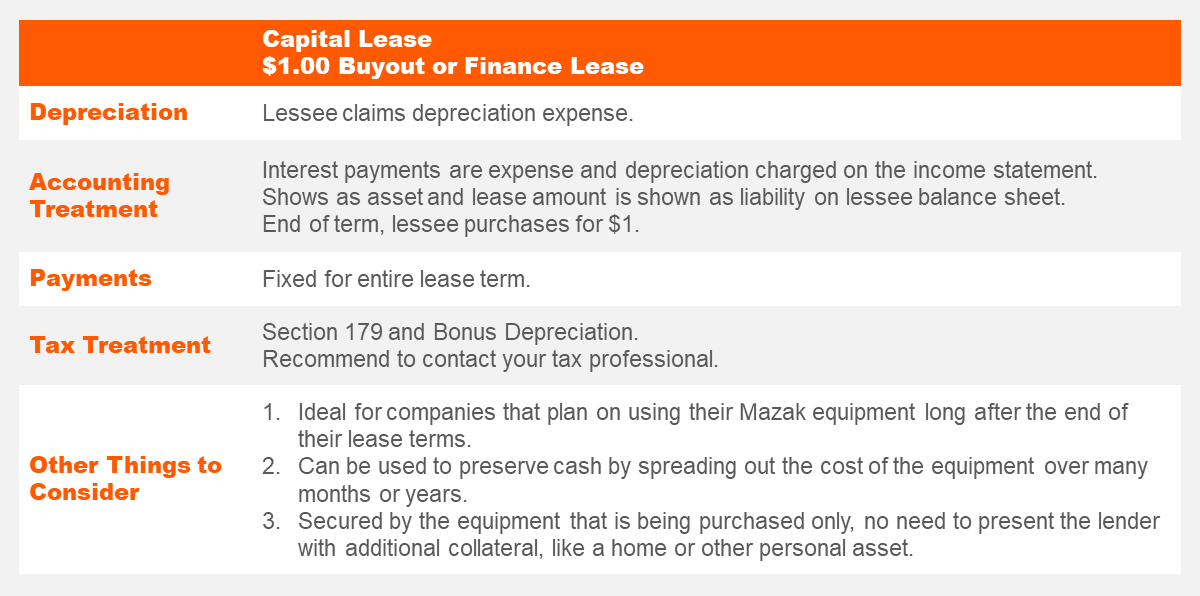

Capital leases, finance leases, and lease purchases

Capital or finance leases are popular for companies that plan to use their Mazak equipment long after the end of their lease terms. It is considered a capital purchase that provides the same accounting and cash flow considerations as a loan which allows the customer to claim the depreciation expense. It also involves low fixed payments for the entire term. The buyout is structured as a purchase obligation rather than a purchase option like an operating lease. This simplifies the property tax requirements and allows customers to purchase their equipment for $1 ($101 in California) at the end of the lease term.

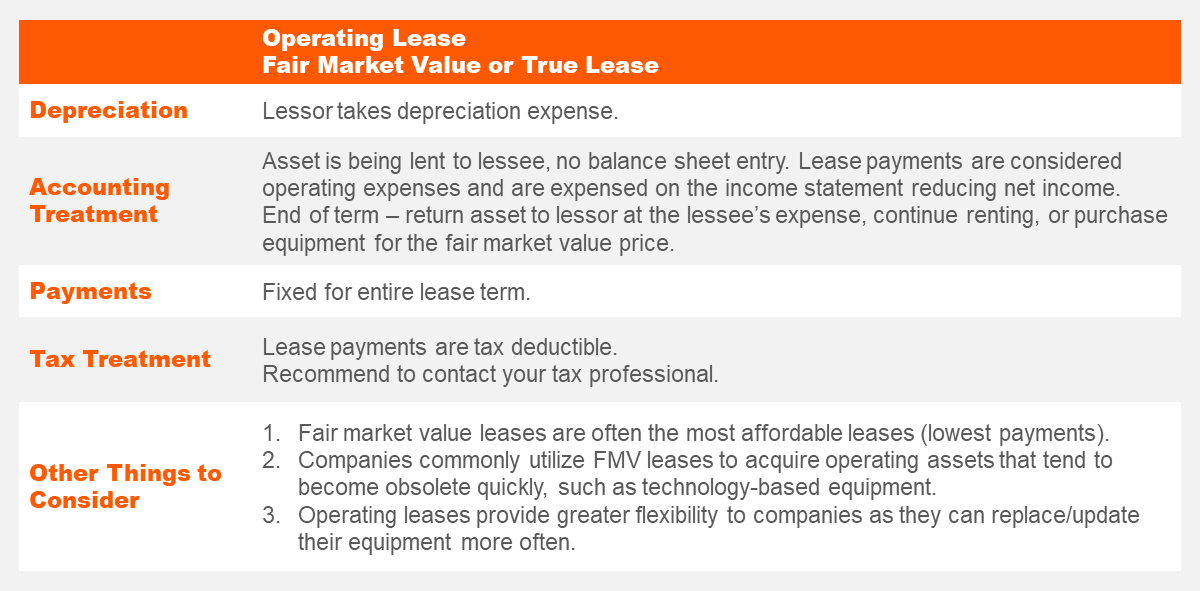

Operating leases, or fair market value leases

Operating leases, also known as fair market value, tax, or true leases provide the lowest monthly payments. The lessor owns the equipment and claims the deprecation deduction. The lessee makes a series of regular, monthly rent payments to the lessor for a period of time. At the end of the lease term, the lessee has the option to purchase the equipment at a price equal to its then fair market value, return the equipment, or continue renting the equipment. The purchase option can be capped or open based on the residual value of the equipment. An early buyout option (EBO) can be quoted if desired. This structure is ideal for companies that plan to upgrade equipment often to have the latest technology or are unsure about purchasing the equipment due to fluctuating market demands.

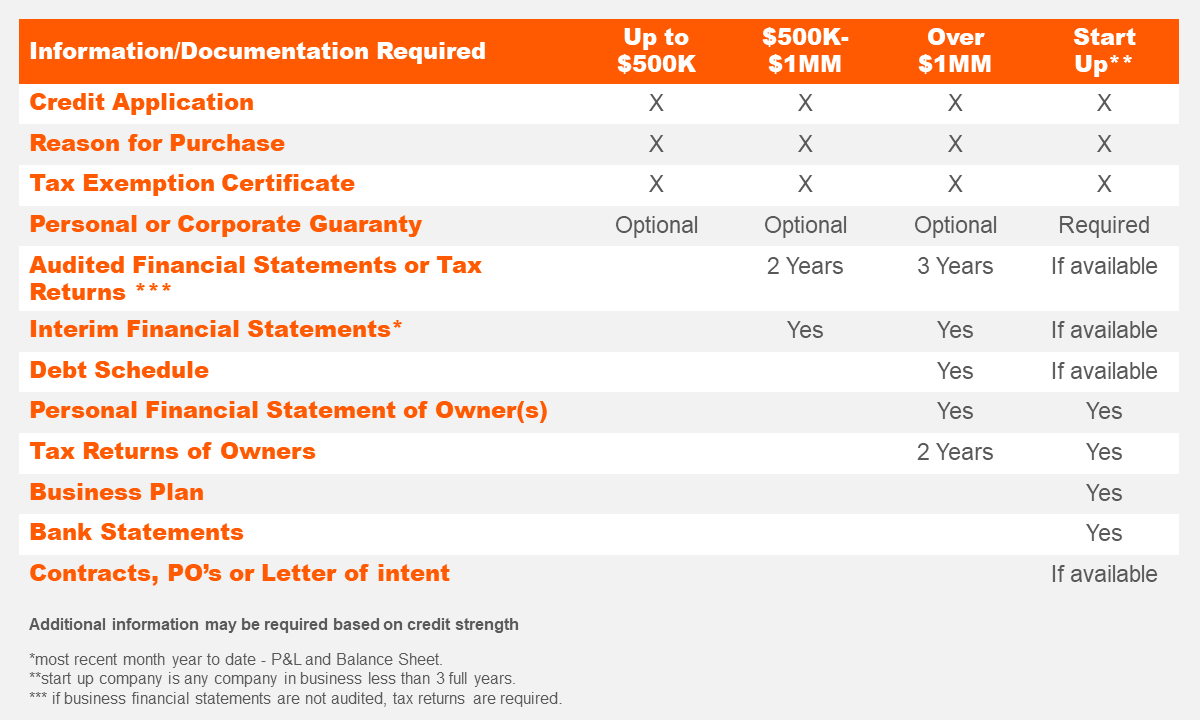

Documentation requirements for financing

Depending on the credit strength of a company and the cost of the machine, different items may be required for financing. Mazak Credit Group offers application only up to $500,000, meaning that only a credit application may be needed in order to obtain credit approval if the balance to finance is $500K or less. Purchases above $500,000 require financial statements. See the table of items that may be needed.

2020 United States tax incentives

Both the Section 179 Depreciation and the 100% Bonus Depreciation are government tax incentives that are available again in 2020. But how do they work?

Section 179 of the IRS tax code allows businesses to deduct, dollar for dollar, the full purchase price of qualifying new or used equipment and/or software purchased or financed during the tax year. Meaning, if you buy or lease a piece of qualifying equipment, you can deduct the full purchase price from your gross income. Qualified equipment purchases exceed $2,500,000.00 and the expensing limit of $1,000,000.00. This is an incentive to encourage businesses to purchase equipment and invest in themselves.

100% Bonus Depreciation is a bonus depreciation that applies to any dollar amount of qualified capital expenditures. The bonus depreciation is generally taken after the section 179 spending cap is reached. This is available for both new and used equipment. This is most useful for businesses spending more than the Section 179 Spending Cap (up to $1,000,000 with a total limit of $2.5 million.

Be sure to consult with your tax professional regarding these incentives. For more information visit the section179 website.

Top 5 reasons for financing with MCC Credit Group

- Provides flexible, timely and competitive financing for companies of all sizes.

- Offers a one-stop, seamless purchasing experience with direct access to delivery and installation schedules.

- Obtains approvals quickly, often in less than 24 hours.

- Creates customized financing programs to meet customer needs.

- Preserve bank credit line for working capital.

Now that you know exactly what you need and what expect with financing your laser-cutting machine, it’s time to sign that sales order.

Apply for Mazak Financing today